This sub-index measures the number of air passengers flying to a city’s airport, as well as the airport’s connectivity to other cities both in the domestic and international market. It assesses the strength of the city’s air cargo sector as well as its container ports and the number of container ship sailings. And finally, it includes a measure of major road networks.

How they link to megatrends

The biggest mobility hubs benefited from decades of globalization and, not

surprisingly, much of the region’s container port capacity lies in China. But that’s changing as

global supply chains shift and countries ranging from India and Morocco to Mexico and Turkey are all

seeing new investment in transport infrastructure.

National economic policies and growth

rebalancing are also driving investments. This is especially the case in Saudi Arabia, where the

country’s Vision 2030 includes a major rewiring and expansion of the logistics sector, from new

airlines and airports to Neom’s Oxagon, a giga-project including an entirely new port and smart

supply chain hub.

Unique features of mobility connectors

Mobility hubs are most often national or provincial capitals, typically located

near industrial clusters. They have major airports to serve both business and leisure travelers as

well as a large number of ports and regular container ship sailings to serve export manufacturing

sectors. They also provide easy land access to larger neighboring markets or to landlocked

neighbors, especially in Africa.

It is that combination of strong sea and air travel, as

well as connectivity to a large domestic and international market, that drives cities higher in our

rankings, and why Shanghai naturally is ranked at the top.

In selecting eight Mobility Connectors to profile, we chose two high-ranking cities from each region to show the diverse circumstances that prevail across such broad geographies and the range of solutions cities are pursuing. Bogotá ranks lower than Dubai, for example, but it’s highly ranked in Latin America.

What might the future look like?

The region’s biggest mobility hubs will only get larger as intra-regional travel and trade grows. Most of the region’s biggest airports and seaports are already committed to expansion plans. However, it’s the rise of midsized mobility hubs that will surprise, especially in countries with large domestic markets, as the rise of midsized cities triggers a boom in domestic flows.

Why does it matter for business?

The rise of midsized mobility hubs will create new aviation corridors similar to domestic corridors in Europe and the United States. The expansion of supply chains across regions will similarly drive new investment into regional ports and airports. But with public debts rising regionally, governments will need to be careful about where they place their high-cost mobility bets. Midsized mobility hubs will meanwhile open up new opportunities for the retail, hospitality, and logistics sectors.

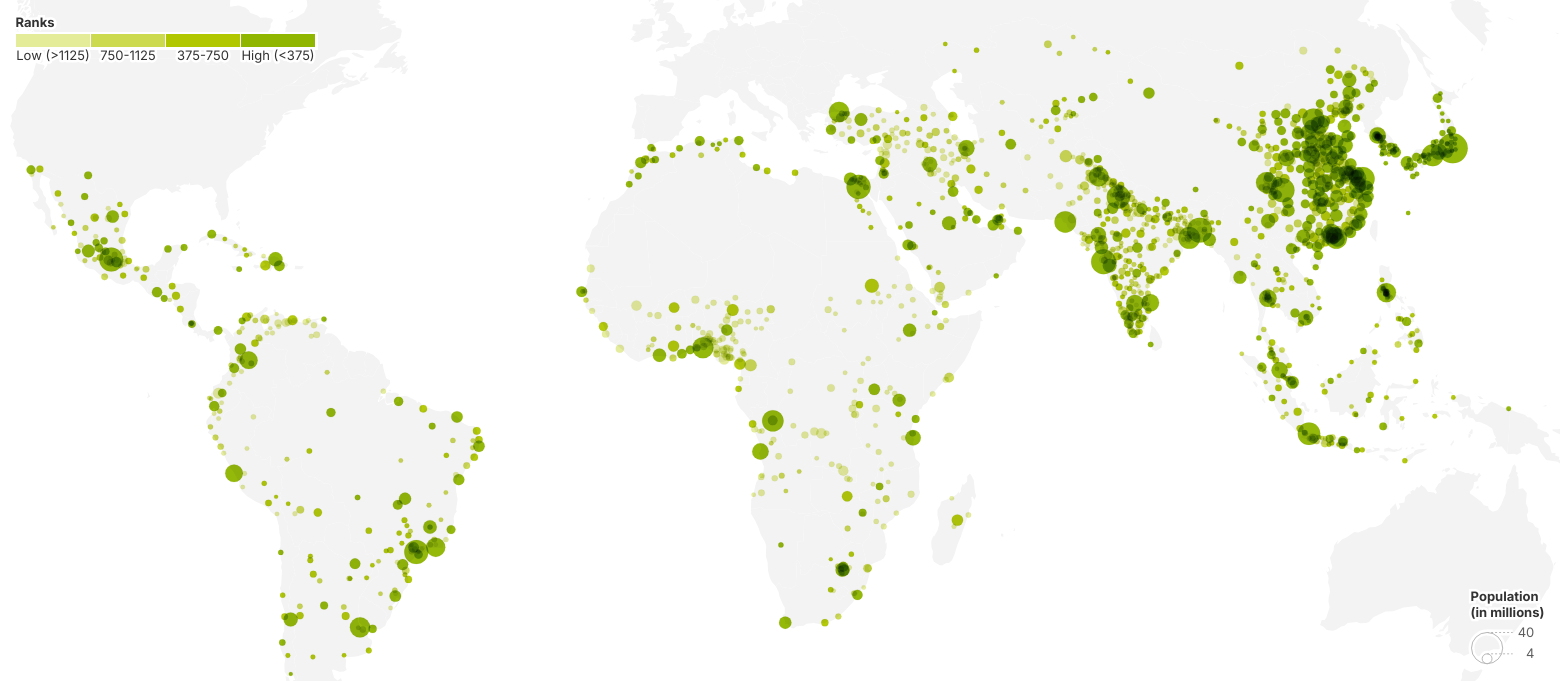

1,500 Mobility Connectors By Region

Population

<500k

500k-1 million

1-5 million

>5 million

1500 (Low Ranks)

>

(Top Ranks) 1

Asia

Middle East

Latin America

Africa

Country

Rank#

Population

1,500 Mobility Connectors By Region

Population

<500k

500k-1 million

1-5 million

>5 million

1500 (Low Ranks)

>

(Top Ranks) 1

Asia

Middle East

Latin America

Africa

Country

Rank#

Population