This sub-index assesses the scale of the manufacturing base, current global export share, and access to nearby air cargo and port infrastructure. It also measures whether a city benefits from global supply shifts, including changes in export share across a range of key products, proximity to major markets, and free trade agreements, as well as qualitative input from dozens of expert interviews.

How they link to megatrends

Chinese cities rank high in this category as they have enjoyed decades of export

growth and foreign investment, and are difficult to displace because of their scale, speed, and

price. Many of these cities produce important goods such as electric vehicles (EVs) or lithium-ion

batteries, and are expected to remain high on our list in coming years.

However, the shift

in global supply chains as global brands and manufacturers seek to rebalance their portfolios is

benefiting a range of other countries capturing share from China, from Ho Chi Minh City and

Guadalajara to Bangalore and Dhaka, whether due to “China plus one” or nearshoring strategies, among

other approaches.

Unique features of export champions

These cities tend to be near transport infrastructure, such as ports and

airports, which makes shipping and business travel easier.

They are often located near

major markets and other manufacturers or businesses, enabling them to benefit from nearshoring

trends.

They also are typically in countries with large populations or located near other

cities with large populations, ensuring there is a supply of labor to tap into.

They are

also often exposed to environmental risks, especially coastal and river flood risks. Others suffer

water shortages.

In selecting seven Export Champions to profile, we chose high-performing cities from each region to illustrate the nuanced circumstances across such broad geographies and the fact that there’s no single formula for success. San Salvador ranks well below global exporting powerhouses like Shenzhen and Ho Chi Minh City, but it demonstrates what’s needed to succeed as an export champion in Latin America.

What might the future look like?

Global supply chain rebalancing will accelerate in coming years. Asia’s cities are the immediate winners given their existing scale. But nearshoring options in Africa and Latin America may yet surprise as they develop greater capabilities.

Why does it matter for business?

Global brands and manufacturers are derisking supply chains and seeking for new

manufacturing locations. Picking the right city is key to long-term stability in supply, as well as

at the right quality and price.

The growth of new manufacturing jobs will, in turn,

contribute to strong spending on retail and other services. Just consider how Shenzhen has grown

from low-end factories to high-end retail.

Logistics firms, real estate developers, and

professional service companies will find new opportunities to support the development of the

region’s new export manufacturers.

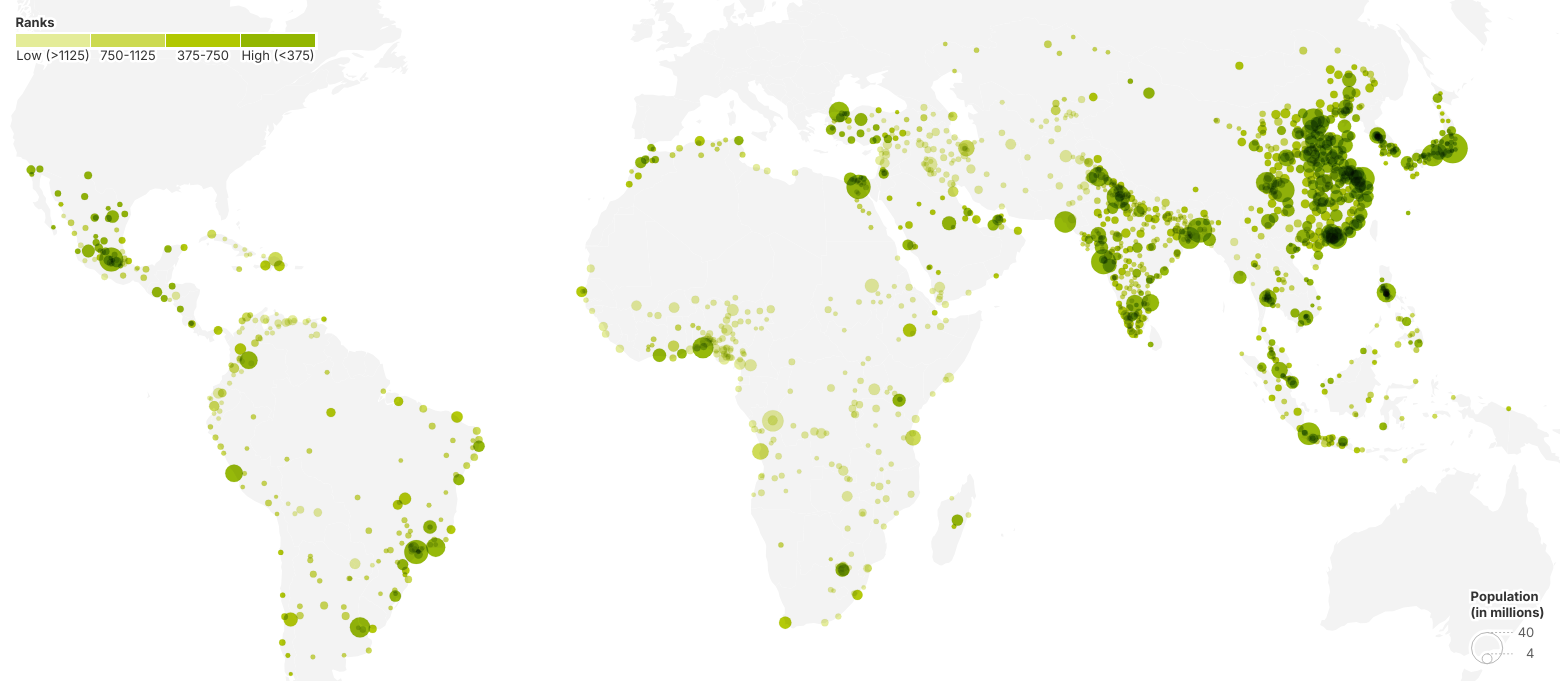

1,500 Export Champions By Region

Population

<500k

500k-1 million

1-5 million

>5 million

1500 (Low Ranks)

>

(Top Ranks) 1

Asia

Middle East

Latin America

Africa

Country

Rank#

Population

1,500 Export Champions By Region

Population

<500k

500k-1 million

1-5 million

>5 million

1500 (Low Ranks)

>

(Top Ranks) 1

Asia

Middle East

Latin America

Africa

Country

Rank#

Population